-

Why Students With Smallest Debts Have the Larger Problem – The New York Times

Financial literacy at k-12 and required before entering college to avoid students having to take out loans and consequences of defaulting on student loans.

-

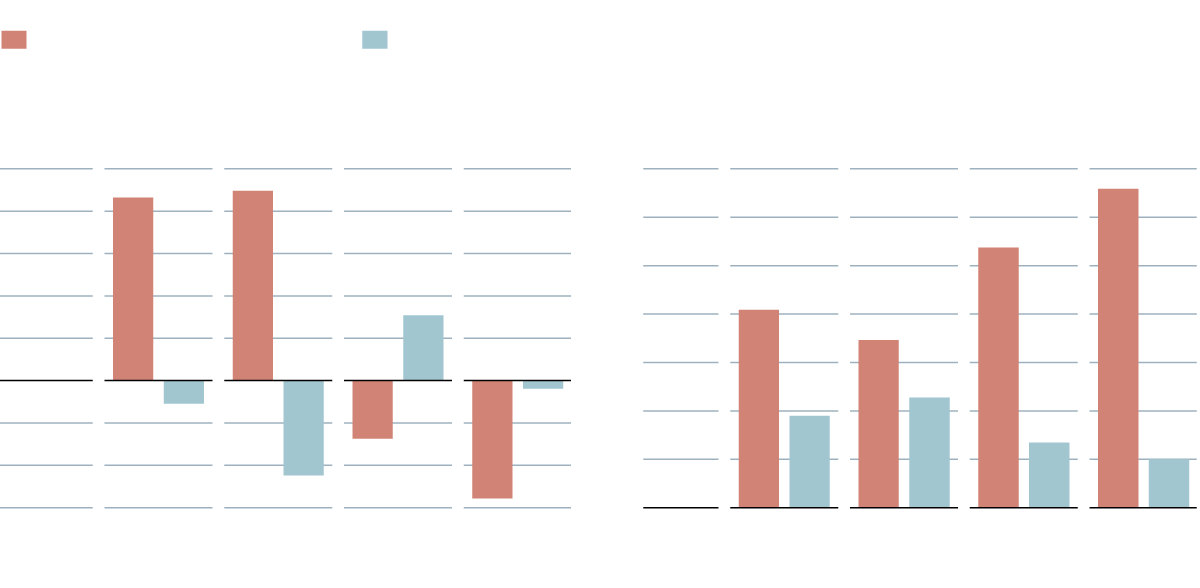

More debt leads to more default. But the reality is surprising: Borrowers who owe the most are least likely to default.

-

Forty percent of new loans go to graduate students. Among those earning law and medical degrees in 2012, median debt (undergraduate and graduate school) is $141,000 for lawyers and $162,000 for doctors.

-

Over the past 50 years, workers with graduate degrees have enjoyed the largest gains of any education group, with their inflation-adjusted earnings nearly doubling since 1964.

-

-

The vast majority of bachelor’s degree recipients do very well. Only 2 percent of undergraduates borrow more than $50,000, and they also aren’t the ones who tend to have problems with their debt.

-

Defaults are concentrated among the millions of students who drop out without a degree, and they tend to have smaller debts.

-

The 3.2 million borrowers in default on these loans owe an average of $15,000, while the other 29.4 million borrowers owe an average of $26,000.

-

Most borrowers have small debts, according to the Federal Reserve Bank of New York; 43 percent borrowed less than $10,000, and 72 percent less than $25,000

-

Getting students to borrow less is not an obvious path to reducing default, since 51 percent of defaulters left college with less than $10,000 in student loans.

-

The United States also has income-based repayment options, but relatively few student borrowers — currently 19 percent of Direct Loan borrowers — are enrolled in them.

-

As is true with the process of applying for student aid, those who most need a helping hand are probably least able to navigate this bureaucracy.

-

The Institute for College Access and Success recommends keeping the standard 10-year repayment plan, but automatically shifting borrowers into an income-based plan if they fall behind on payments.

-

-

Higher Education Protects Wealth During Tough Times – Unless You’re Latino

Maybe because Blacks and Latinos are disproportionately employed in the public sector where there are fewer salary increases that keep up with the rate of inflation. Blacks and Latinos took on debt for a degree then more debt to purchase a home.

-

-

In a study from the Federal Reserve Bank of St. Louis, researchers found that higher education doesn’t offer those of a brown or black hue the same kind of protection it does white and Asian people who have matching four-year college degrees.

Studying both the 2007 and 2013 periods, authors William Emmons and Bryan North learned that the education-wealth gap exists in both long-term and short-term cases of economic downturn.

According to the report, between 2007 and 2013, black families headed by someone with a college degree experienced a median wealth decline of 60 percent. For Latinos, the loss was even greater. College-educated Hispanic households felt a 72 percent drop to their median real net worth. In contrast, white families headed by someone with a four-year college degree witnessed a 16 percent drop in wealth, while equally educated Asian households actually gained 5.1 percent more in their median real net worth.

PLUS: 8 Latinas Who Support Equal Pay

While the report doesn’t explain why these inequities exist among higher-educated families of different races, Emmons and North do suggest that debt might play a major role. For instance, in 2007, black and Latino households had median debt-to-income ratios that far exceeded white and Asian families.

-

-

I defaulted on my student loans – here’s how it happened, and how I’m handling it – Business Insider

A sad story of coping with crushing debt both student loan and medical debt then triumph and relief the rush of living debt free is sweet indeed.

-

I worked with a certified credit counselor to finally clean up my finances: I had $33,000 in student loans, $30,000 in credit card debt, plus those hospital bills.

-

In 2009 I defaulted, owing $30,000. Sallie Mae offered to settle, which would have saved me 30%, but you can’t get blood from a stone.

-

2008, when I had a massive heart attack. I couldn’t believe it. I was only 37 and ran 10 miles a day.

-

We had to rely on credit cards for food and her $1,200 monthly medicine tab.

-

I graduated on time in 1994 — with roughly $60,000 in student loan debt.

-

I was left to pay for my education, which was about $30,000 a year.

-

Throughout my predicament, I was proactive in trying to manage my finances responsibly. I wasn’t hiding from the debt, and I sought assistance. But I’ve learned you can’t control everything in life.

-

-

Fafsa Follies: To Gain a Student, Eliminate a Form – The New York Times

Time to phase out the FAFSA with a simple solution to increase college attendance that will lead to graduation. Use IRS information avoid duplication and complexity simplify simplify.

-

Students must fight through thickets of paperwork and endure long delays to obtain definitive information about the aid for which they qualify. Many give up before they learn that college is affordable.

-

cut the lengthy federal aid application, now longer than the typical 1040 Internal Revenue Service form, to just two questions.

-

The widely despised form known as the Fafsa (which stands for Free Application for Federal Student Aid) is unnecessary

-

tax filers could just check a box on the 1040 to learn immediately about eligibility for federal grants, loans and tax credits.

-

But a large body of evidence from economics and psychology shows that even minor bureaucratic hurdles can keep people from making smart investments in their futures.

-

Research shows that in these situations people deviate systematically from rational behavior, often to their own detriment.

-

The streamlined process increased the share of low-income young people who attended college for two years by eight percentage points (to 36 percent from 28 percent).

-

Eliminating the Fafsa and relying on tax data to calculate aid eligibility is the clearest route to permanent simplification.

-

Why do these high-income families qualify for aid by simply filing their taxes, while low-income families must fill out the Fafsa to qualify for a Pell Grant? We have created an aid system that is most complicated for the low-income families who are its target.

-

We found that dozens of questions on the Fafsa contribute virtually nothing to the determination of grant aid.

-

The Fafsa burdens families and prevents students from attending college, while doing little to target federal aid.

-

-

For Some Art School Grads, Loads of Debt and Few Jobs Prospects | Observer

Buyer beware sounds like we have seen this story repeated over and over where are these students today?

-

Approximately 40 millions Americans currently have student loan debt, and the average balance stands at $29,000, according to a 2014 report from CNN Money.

-

sinks prospective arts students into debt and leaves them with few job options and little career guidance. And with federal loans paying lots of the bills, the school’s founders aren’t too concerned about graduates’ ability to pay back their hulking loans.

-

On the school’s lackluster graduation rates, Ms. Stephens told Forbes, “If a student can get that portfolio built before they finish all their requirements, and they get a job in their field of study, then we don’t want to keep them here. The diploma won’t make one bit of difference.”

-

Perhaps most troubling is how AAU grads can often hold as much debt as a graduate of an elite liberal arts college—or more, even. Tuition runs students $22,000 per year, before the cost of living in San Francisco, where the median rent is a staggering $4,225.

-

-

Racial Wealth Gap Persists Despite Degree, Study Says – The New York Times

Improve k-12 quality then post secondary; STEM students receive free education.

-

-

a new study has found that for black and Hispanic college graduates, that shield is severely cracked, failing to protect them from both short-term crises and longstanding challenges.

-

“White and Asian college grads do much better than their counterparts without college, while college-grad Hispanics and blacks do much worse proportionately.”

-

“Higher education alone cannot level the playing field,” the report concludes

-

But while these college grads had more assets, they suffered disproportionately during periods of financial trouble.

-

From 1992 to 2013, the median net worth of blacks who finished college dropped nearly 56 percent (adjusted for inflation).

-

-

Another central factor is the heavy debt many blacks and Hispanics accumulate to achieve middle-class status.

-

While the average value of a home owned by a white college graduate declined 25 percent, homes owned by black and Hispanic grads fell by about twice that.

-

The housing boom and bust particularly whipsawed college-educated Hispanics: From 2007 to 2013, their net worth fell a whopping 72 percent.

-

Under a democratic president

-

-

Substantially narrowing the racial and ethnic wealth gap, Mr. Boshara and the study’s authors suggest, would require policy changes to expand the availability of a quality college education without forcing students into outsize debt.

-

While the recession has caused especially steep declines in black and Hispanic wealth, the study contends that the problem is deeply rooted and more persistent.

-

Blacks have fewer advanced degrees, and the ones who do are more often in lower-paying fields or graduates of colleges with lesser reputations.

-

“Blacks and Latinos at all education levels, including college and advanced degrees, earn less than their white counterparts, which means lower lifetime earnings” and less ability to save, said John Schmitt, research director at the Washington Center for Equitable Growth, who reviewed an advance copy of the report.

-

Blacks and Hispanics are also less likely than whites to inherit money or receive help from their parents to cover a tuition bill or a down payment on a house.

-

a family headed by a black college graduate has less wealth on average than a family headed by a white high school dropout.

-

“Prior family wealth is the key,” Mr. Darity explained in an email, noting that it “shapes both income-generating opportunities and the capacity to allow wealth to grow more wealth.”

-

-

Refresh websites and social media with daily content on students securing employment, new courses or degrees/certificates, update on graduates where are they now, connect with alumni; campus events.

-

"The Great Unbundling of Higher Education" – HigherEdJobs

Time for colleges and universities to implement real-time learning that offers high school students and adults skills and training that will lead to a career and like Ryan mentions if you get corporate involvement that means free education to those that need it the most.

-

Currently a university’s reputation relies heavily on the "four Rs" in which the most elite schools thrive–rankings, research, real estate, and rah! (i.e. sports). But for the majority of students who are not attending these elite institutions, the "four Rs" offer poor value for the expense of a college education.

-

The college degree is higher education’s version of the bundle. In the tuition price of a degree program, colleges and universities combine a vast array of products and services – some educational, some not.

-

In the enrollment declines evident across a range of non-elite institutions – from for-profits to law schools to liberal arts colleges – many observers see the beginning of the rejection of the bundle by the American higher education consumer.

-

Consumer preferences are shifting to smaller/faster/cheaper products I call "Just-In-Time" (JIT) education. Coding bootcamps – the first manifestation of JIT – are experiencing remarkable growth. One recent survey projected 138 percent growth from 6,740 graduates in 2014 to a 16,056 2015 – greater than any other sector or program in postsecondary education.

-

The JIT revolution isn’t limited to coding. Take YearUp, for example. YearUp is Boston-based not-for-profit that provides JIT pathways to a professional career for underprivileged students. The program combines 21-week educational programs in several functional areas – IT, operations and finance, sales and marketing, and customer service – with a 26-week internship at employer partners. Moreover, YearUp is definitely not a "Top-Up" program for students who’ve already earned degrees. The program serves students who otherwise can’t access, or are unlikely to succeed at, traditional colleges.

-

JIT also opens up the door to a new revenue model for colleges and universities.

-

The U.S. Department of Education (ED) is well ahead of our colleges and universities in recognizing the potential of JIT.

-

Today’s colleges and universities are already too much like debutante balls in their failure to promote social mobility; you shouldn’t have to be a deb, or know one, to have the opportunities that a great college can provide.

-

The Great Unbundling of higher education will mean many changes for our programs, institutions, faculty and – most important – students. Those of us that don’t begin to prepare for the unbundling of degree programs may find ourselves a decade from now with the time – but perhaps not the money – to attend debutante balls.

-

-

Bill Gates, College Dropout: Don’t Be Like Me – NYTimes.com

-

“Although I dropped out of college and got lucky pursuing a career in software, getting a degree is a much surer path to success,”

-

“College graduates are more likely to find a rewarding job, earn higher income, and even, evidence shows, live healthier lives than if they didn’t have degrees. They also bring training and skills into America’s work force, helping our economy grow and stay competitive.”

-

-

“The problem isn’t that not enough people are going to college,” Mr. Gates writes. “The problem is that not enough people are finishing.” About one-fifth of the working-age population, he notes, have attended some college without earning a degree.

-

The broader economic weakness over the past 15 years — which has affected college graduates, too — has created a fair amount of cynicism about college

-

Education, as David Autor, the

M.I.T. economist, notes, is not a game of musical chairs. More educated societies generally become richer, healthier and better functioning over time. -

“The evidence favors the idea that human capital investments pay off over the medium and long term.”

-

-

Data That Will Vex Online Education Critics | EdSurge News

-

“It’s a bit of a paradox,” said Shea. “They’re doing worse at the course level, but at the program level — despite lower grades — they’re finishing.”

-

Johnson says the solution is to make the online courses better and more effective. But computerized instruction is still in its infancy, so that dream may be a long way off.

-

where graduation rates are very low; only 25 to 30 percent of students who start at a community college complete their degrees or transfer to a four-year school.

-

“If you’re really motivated and intent on getting out in a timely manner, online classes are almost essential.”

-

And they’re graduating in larger numbers than the face-to-face students because it’s easier to enroll in the online classes you need.

-

Yet the students who took at least some of their classes online were more likely to transfer to a four-year college or earn their associate’s degree. “The long-term outcomes are better for students who take online classes,” Johnson confirmed.

-

Peter Shea, who is the associate provost of online learning at the University of Albany SUNY, contacted me to share his research findings. Community college students who take online courses are more likely — 25 percent more likely to be exact — to complete their two-year associate’s degree or some sort of certificate than students who didn’t take any online classes.

-

Not everyone is failing online courses. For the 60 percent of students who are passing an online class, they’re earning their way through their course requirements.

-

-

How to Make Online Learning Accessible for Students with Learning Challenges | EdSurge News

Make learning universal to all students

-

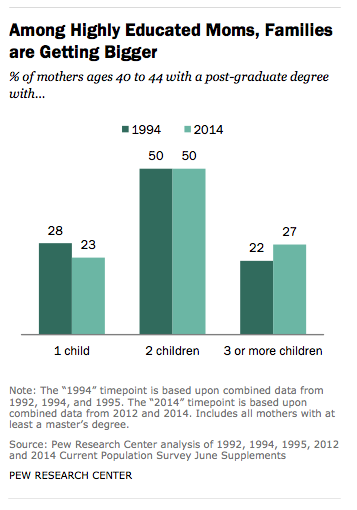

More Highly Educated Women Are Having Children – Real Time Economics – WSJ

-

Corinthian Colleges’ Lean Business Model Leaves Little for Creditors – NYTimes.com

-

The Economic Value of College Majors | CEW Georgetown

Based on the evidence I can see why some colleges and universities are phasing out the liberal and humanities over more practical fields such as Career Technical Education or STEM careers that have greater Return on Investment ROI.

-

"Nation must address the ‘student debt crisis’" – HigherEdJobs

-

Burdened With Debt, Law School Graduates Struggle in Job Market – NYTimes.com

-

-

Jonathan Wang has not practiced law since he graduated from

Columbia Law School in 2010, but he did not plan it that way. -

About 20 percent of law graduates from 2010 are working at jobs that do not require a law license, according to a new study, and only 40 percent are working in law firms, compared with 60 percent from the class a decade earlier. To pay the bills, the 2010 graduates have taken on a variety of jobs, some that do not require admission to the bar; others have struck out on their own with solo practices. Most of the graduates have substantial student debt.

-

The legal profession was undergoing the early wave of turbulence that left graduates in subsequent classes facing a harsher job market that has shown few signs of a robust recovery.

-

She concluded that the 2010 class had not recovered in the ensuing years.

“Employment has improved only marginally for the class,” she said, “with unemployment at 6 percent, many fewer lawyers working at law firms and a leap in the percentage of solo practitioners.

-

“too ashamed that I have not found a legal job”

-

“I dare not put it on my résumé because it makes you instantly nonprestigious and unemployable,”

-

And, like more than 80 percent of law school graduates, he has substantial student debt.

-

-

Incredible student loan debt!!

-

-

Over all, nearly 85 percent of law graduates have taken out student loans, according to the website Law School Transparency, and 2010 law graduates accumulated debt averaging $77,364 at public law schools and $112,007 at private ones.

-

Many have received financial hardship deferments or, like Mr. Shirkey, who accumulated $328,000 in student debt, including some undergraduate loans, received credits for public interest work.

-

“Every time I look at the debt amount,” he said, “my heart beats a little harder.”

-

“I thought the LSAT tutoring gig was going to be a temporary thing, but five years and one bar admission renewal later, here I am,” he said.

-

“I waffle constantly, but I’m still in the mind-set that I need to find a real job,” he said.

-

-

Why Coding Is Your Child’s Key to Unlocking the Future – WSJ

Coding should be part of the curriculum in every k-12 school in the USA with sponsorship from the tech community.

-

Codestudio, the online education program offered by Code.org, already reaches 1 in 10 grade-school students in the U.S., says Mr. Partovi. Of those students, 43% are female, and 47% are African-American or Hispanic.

-

In fact, in record numbers, children are picking up a skill their parents don’t possess: coding.

-

programming is just the beginning. What those kids are learning now—what they must learn, if they hope to be employable in the 21st century—is something educators call “procedural literacy.”

-

“When you learn to code, you start thinking about processes in the world,” says Mitchell Resnick, the Massachusetts Institute of Technology professor heading up the effort to build the child-friendly programming language Scratch.

-

coding is uniquely suited to training children not just how to solve problems, but also how to express themselves, says Mr. Resnick.

-

“What’s fascinating about computer science is that it requires analytical skills, problem solving and creativity, while also being both foundational and vocational,” says Hadi Partovi, co-founder of Code.org,

-

It doesn’t hurt their cause that the Bureau of Labor Statistics projects that there will be one million unfilled jobs for programmers in the U.S. by 2020.

-

admitting that coding is part of the liberal arts, and therefore a core skill every child must possess.

-

Coding is, in a way, just another form of writing, albeit one aimed at creating stories that are interactive and dynamic, says Mr. Resnick.

-

But for parents who aren’t waiting around, the options for teaching children how to code at home are growing.

-

Tablets are a natural vehicle for learning even for children who can’t yet read.

-

Everyone I interviewed observed that the best way to reach young children was to get them to create games, or to treat learning exercises as a form of play.

-

-

Parchment study highlights student demand for digital credentials | Education Dive

With the emergence of socail media and learning management systems students need to be recognized for their work and effort in addition digital credentials

-

College for the Masses – NYTimes.com

Best to move on to a four-year degree for expanded economic opportunities even at the risk of incurring student loan debt just wisely select a degree that is in demand.

-

How much money should taxpayers spend subsidizing higher education? How willing should students be to take on college debt? How hard should Washington and state governments push colleges to lift their graduation rates? All of these questions depend on whether a large number of at-risk students are really capable of completing a four-year degree.

-

Students who score an 830 on the SAT are nearly identical to those who score an 840. Yet if one group goes to college and the other doesn’t, researchers can make meaningful estimates of the true effects of college.

-

Enrolling in a four-year college brings large benefits to marginal students.

-

The benefits were concentrated among lower-income students, both studies found, and among men, one of them found.

-

Strikingly , the students who initially enrolled in a four-year college were also about as likely to have earned a two-year degree as the other group was. -

That finding is consistent with other research showing that students do better when they stretch themselves and attend the most selective college that admits them, rather than “undermatching.”

-

“If you give these students a shot, they’re ready to succeed,”

-

. More broadly, a long line of research has found that education usually pays off — for individuals and societies — in today’s technologically complex, globalized economy.

-

Some liberals seem worried that focusing on education distracts from other important economic issues, like Wall Street, the top 1 percent and the weakness of labor unions.

-

Enrolling more students in community colleges may well make economic sense. So, in all likelihood, would creating more and better vocational training, for well-paid jobs like medical technician and electrician, which don’t require a bachelor’s degree. The United States, Mr. Autor says, “massively underinvests” in such training.

-

Millions of people with the ability to earn a bachelor’s degree are not doing so, and many would benefit greatly from it.

-

The unemployment rate among college graduates ages 25 to 34 is just 2 percent, even with the many stories you hear about out-of-work college graduates.

-

College graduates are also healthier, happier, more likely to remain married, more likely to be engaged parents and more likely to vote, research has found.

-

But the new findings are the latest, and maybe strongest, reason to believe that college matters.

-

“I fell in love with learning,” he recalls. With his parents suffering financial problems, he worked almost full time while in college

-

Today, he is a psychotherapist at a local high school and also counsels adults as a professional coach.

-

Doing so helps them learn how to finish other obstacle courses and gives them the confidence that they can, so long as they stay focused. Learning to navigate college fosters a quality that social scientists have taken to calling grit.

-

“Just walk around. There is something about that energy on campus that makes you want to be better.”

-

how many students fall down and don’t figure out a way to keep going. Dropout rates typically hover around 50 percent, which leaves students with the grim combination of debt and no degree

-

Many community colleges have even higher dropout rates than four-year colleges. And most people with no college education are struggling mightily in the 21st-century economy.

-

Is college for everyone? Surely not.

-

Others would rather not spend four more years in school and can find rewarding, well-paying work as a medical technician, dental hygienist, police officer, plumber or other jobs that require a two-year degree or vocational training.

-

“It’s genuinely destructive to give people the message that we’re overinvesting in college, that we’re in a college-debt bubble, that you’ll end up as an unemployed ethnomusicologist with $200,000 in debt working at Starbucks,” Mr. Autor, the M.I.T. economist, said. “That’s not a message you would want to give to anyone you know who has kids.”

-

Back then, a high school education was the new ticket to the middle class. Today, a college education is.

-

Americans agree that “our kids” should go to college. The debate is really about who qualifies as “our kids.”

-

Privacy Overview

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookies

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

I’m in 10th grade right now at the moment and am an Asian- American female and my current path that I’m looking to go down is the medical field either in the surgery field or the chemistry field thatdeals with pharmeceuticals. I would like to go to a well- known medical school in order to expand my knowledge in the field I would like to go into. I would like to go to school, but I’m facing the problem of student debts and not wanting to have to pay off debts for much of my career. I would like to know more in depth about how to go to a good college without a lot of debt.