-

Verification of employable skills and knowledge by Fortune 500 companies will have more weight than a traditional college degree that says little about a college graduate. To lower college tuition and increase the employability of people with and without college degrees colleges and private companies must develop an alternative to the traditional degree granting model.

-

-

enrollment in traditional colleges remains robust, and undergraduates are paying higher tuition and taking out larger loans than ever before. Universities do not seem poised to join travel agents and video stores on the ash heap of history — at least, not yet.

-

Colleges are holding technology at bay because the only thing MOOCs provide is access to world-class professors at an unbeatable price.

-

Now information technology is poised to transform college degrees. When that happens, the economic foundations beneath the academy will truly begin to tremble.

-

Degrees give meaning and structure to collections of college courses.

-

Most important, traditional college degrees are deeply embedded in government regulation and standard human resources practice.

-

Private-sector employers often use college degrees as a cheap and easy way of selecting for certain basic attributes, mostly the discipline and wherewithal necessary to earn 120 college credits.

-

Free online courses won’t revolutionize education until there is a parallel system of free or low-fee credentials, not controlled by traditional colleges, that leads to jobs.

-

Badges indicate specific skills and knowledge, backed by links to electronic evidence of how and why, exactly, the badge was earned.

-

The fact that colleges currently have a near-monopoly on degrees that lead to jobs goes a long way toward explaining how they can continue raising prices every year.

-

The capstone project requires students to build a data model and create visualizations to communicate their analysis.

-

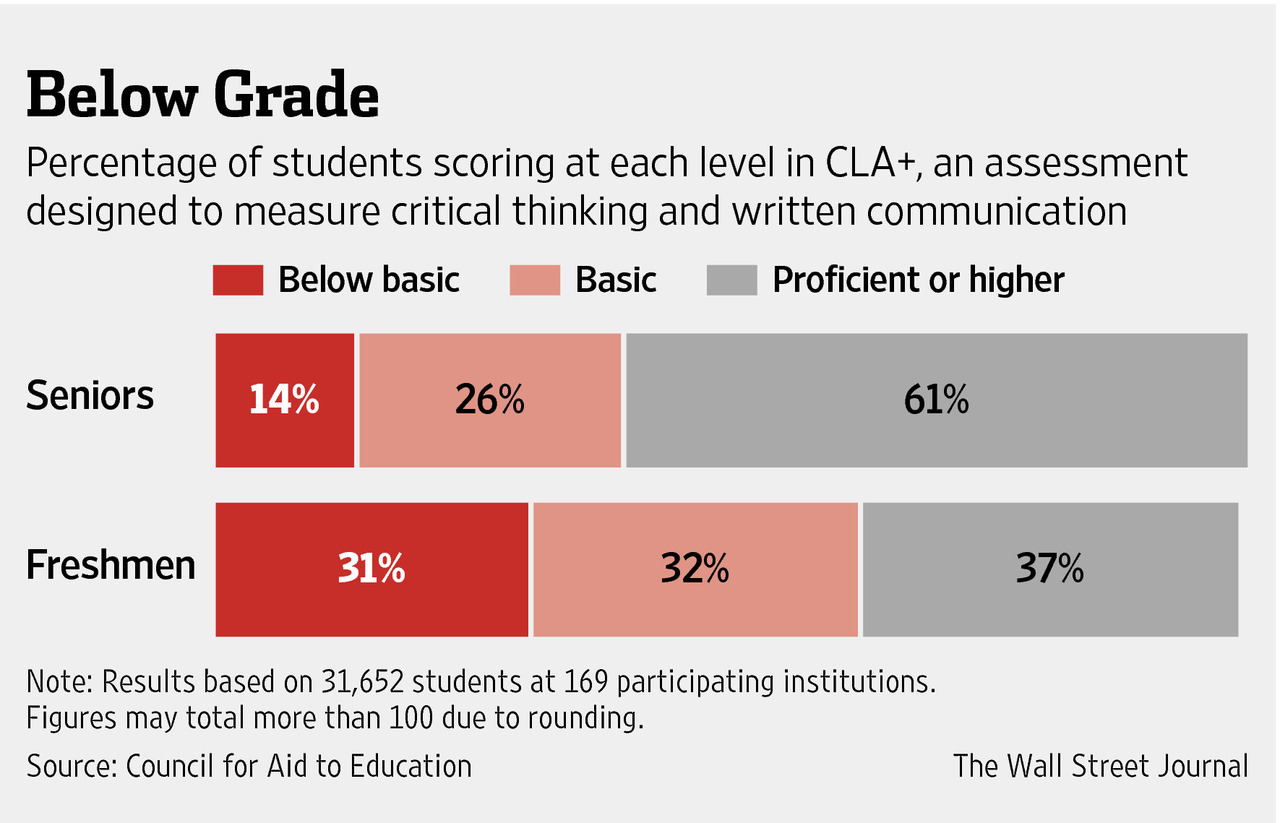

But employers have a powerful incentive to move in this direction: Traditional college degrees are deeply inadequate tools for communicating information.

-

College transcripts are a nightmare of departmental abbreviations, course numbers of indeterminate meaning, and grades whose value has been steadily eroded by their inflation.

-

This has the effect of reinforcing class biases that are already built into college admissions.

-

Because diplomas and transcripts provide few means of reliably distinguishing the great from the rest, employers give a leg up to private college graduates who probably had some legs up to begin with.

-

The new digital credentials can solve this problem by providing exponentially more information.

-

Digital learning environments can save and organize almost everything.

-

My “real” college courses, by contrast, are lost to history, with only an inscrutable abbreviation on a paper transcript suggesting that they ever happened at all.

-

In a world where people increasingly interact over distances, electronically, the ability to control your online educational identity is crucial.

-

Companies such as LinkedIn are steadily building new tools for people to describe their employable selves. College degrees, by contrast, say little and never change.

-

But their true impact won’t be felt until students and learners of all kinds have access to digital credentials that are also built for the modern world. Then they’ll be able to acquire skills and get jobs for a fraction of what colleges cost today.

-

-

The Promise and Failure of Community Colleges – NYTimes.com

We need more incentives to cajole community colleges to fulfill their mission to yield outcomes that will close the achievement gap.

-

“It’s unrealistic to think we can have a better outcome without investing more money.”

-

“Community colleges have the students with the greatest problems — yet they get the least resources,”

-

It is structuring the federal aid in a way that, it hopes, will push states and colleges to invest in empirically tested strategies to improve retention and graduation rates. And it is encouraging them to create curriculums that prepare students either for a four-year college transfer or for an in-demand job.

-

MDRC, a nonprofit organization that evaluates social policies, found that the accelerated study program roughly doubled the three-year graduation rate among the most disadvantaged students, those who initially needed remediation classes.

-

Or perhaps the true challenge is even earlier, from birth to age 3 or 4, as the Nobel laureate

James Heckman from theUniversity of Chicago has been urging for years, when investments in cognitive and emotional capabilities have an enormous impact on children’s future development. -

Most are not truly prepared for college, requiring remedial courses in math or English before they receive their first higher education credit.

-

But Mr. Obama’s plan risks falling well short of its ambitions.

-

Community colleges have been consistently ignored by policy makers who equate higher education with a bachelor’s degree — mostly ignoring the fact that a very large group of young Americans are not prepared, either financially, cognitively or socially for that kind of education.

-

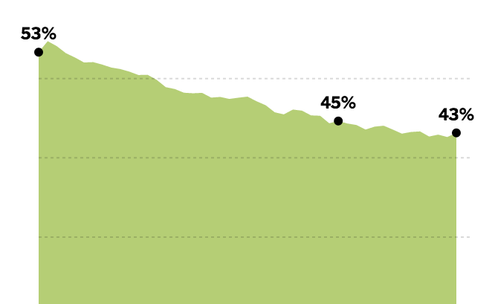

Community college graduation rates have been declining over the last decade.

-

Today, only 35 percent of a given entry cohort attain a degree within six years, according to government statistics.

-

There are many community colleges with much worse records.

-

What the president chose not to emphasize is that precious few of the students at community colleges are likely to fulfill the promise and complete their education.

-

With open enrollment and an average price tag of $3,800 a year for full-time students, community colleges are pretty much the only shot at a higher education for those who don’t have the cash or the high school record to go to a four-year university. And that’s a lot of people: 45 percent of the undergraduate students in the country.

-

But giving up on community colleges would be even worse, because some promising experiments point the way to a more successful path.

-

-

The Tax-Smart Way to Withdraw ‘529’ Funds – WSJ

Use all the available education tax advantages to save you money.

-

Closing Education Gap Will Lift Economy, a Study Finds – NYTimes.com

A small investment in k-16 education can yield tremendous economic benefits to our country.

-

Study after study has shown a yawning educational achievement gap between the poorest and wealthiest children in America.

-

concluded the United States could ultimately enrich everybody by improving educational performance for the typical student.

-

That could lead to roughly $900 billion in higher government revenue, more than making up for the cost of such an effort.

-

the United States’ gross domestic product would rise by an additional 6.7 percent, a cumulative increase of $10 trillion (after taking inflation into account) by the year 2050, the report estimated.

-

In the three decades that followed the end of World War II, almost all Americans, no matter where they fell on the earnings scale, enjoyed at least a doubling of their real incomes.

-

-

Mr. Lynch explained, is to show that the added cost of improving educational achievement at the bottom would be more than made up for by the rise in economic output and tax revenue.

-

Lifetime earnings of the poorest quarter would jump by 22 percent in this event.

-

An analysis by the O.E.C.D. released last fall showed that the United States greatly lagged nearly every advanced industrial nation on measures of educational equality.

-

-

A Quiet Revolution in Helping Lift the Burden of Student Debt – NYTimes.com

-

Student loan debt is at a record high of $1.1 trillion, and the average undergraduate who borrows to attend school graduates nearly $30,000 in debt. Almost 20 percent of student borrowers are in default.

-

The result may make it much easier for students to get out from under their debts.

-

But the bill that President George W. Bush later signed contained another modest change in the law that would later gather significance.

-

Any balance remaining after 25 years of payments was forgiven.

-

But the repayment option wasn’t available to students who borrowed under the private sector loan program.

-

Monthly payments were capped at 15 percent of income, rather than 20 percent, and the living expense deduction was raised significantly.

-

Loan balances would be wiped clean after only 10 years for people who worked in public service jobs, broadly defined as anywhere in the government or nonprofit

-

“College degrees pay off in the long run, but many graduates struggle to manage their debt upon graduation,”

-

Under an income-based repayment, if you make little money, you repay little money.

-

People who work in government or nonprofits are still eligible for forgiveness after a decade.

-

Students have to apply for IBR, and it took time for the

Education Department to spread the word. -

The historical social contract used to be straightforward. All citizens were eligible for generous government college subsidies in the form of low tuition at public colleges and universities.

-

Nobody said that a college graduate who ultimately paid back less in taxes than the amount of his or her original tuition subsidy had “defaulted,” because it was understood that luck, business cycles and career choices vary, and that the collective result for all students was good for society.

-

Those who earn less, for whatever reason, pay less. Nobody will ever default simply because they can’t afford to pay.

-

The teacher will pay only $18,360 in total on the loans, and $48,840 in principal and accumulated interest will be forgiven after 10 years.

-

Using a debt system to make college affordable has always been an awkward fit.

-

While home and car loans are backed by assets that can be repossessed, banks can’t seize a college degree.

-

The change in college financing has a potentially serious drawback when it comes to college pricing

-

-

Mitchell E. Daniels: How Student Debt Harms the Economy – WSJ

Solve the student debt bomb.

-

Ever-escalating tuitions, especially in the past dozen years, have produced an explosion of associated debt, as students and their families resorted to borrowing to cover college prices that are the only major expense item in the economy that is growing faster than health care

-

Between 25% and 40% of borrowers report postponing homes, cars and other major purchases. Half say that their student loans are increasing their risk of defaulting on other bills.

-

A variety of indicators suggest that the debt burden is weighing on the engine that has always characterized American economic leadership

-

From 2010 to 2013, the Journal reported on Jan. 2, the percentage of younger people who reported owning a part of a new business dropped to 3.6% from 6.1%.

-

Among its findings: 26% of those who left school debt-free have started at least one business. Among those with debt of $40,000 or more, only 16% had done so.

-

For future generations to enjoy the higher living standards America has always promised, nothing matters more than that the U.S. remains a land where miracles of innovation and entrepreneurship happen consistently.

-

-

-

"California Community Colleges to Offer Bachelor’s Degrees" – HigherEdJobs

Finally allow some competition to lower the cost of tuition and increase the number of college grads in the state.

-

Fifteen California community colleges received preliminary approval Tuesday to start offering career-oriented bachelor’s degrees, a step that represents a first for the nation’s largest college system and that supporters said is needed to ensure residents are prepared for jobs that in the past may have required only two years of training.

-

Emergency services, dental hygiene, automotive technology, respiratory care and mortuary science are some of the degrees the participating colleges plan to offer.

-

Local employers have been telling college officials for some time that they require new hires to hold four-year degrees,

-

Twenty other states have community colleges that offer bachelor’s degrees, according to the Community College Baccalaureate Association.

-

Under the legislation, students earning their baccalaureates would pay an additional $84 per unit for upper-division courses on top of the regular per-unit fee of $46 per unit, for a total of $132

-

-

Test Finds College Graduates Lack Skills for White-Collar Jobs – WSJ

-

The $140,000-a-Year Welding Job – WSJ

No college degree or student loan debt but a high paying job after only two years in a technical training program. A welder earns more than a starting teacher or maybe attorney. College will always be there.

-

Obama Calls for Two Years of Free Community College for All Students – WSJ

I think the best approach would be to partner with business and sponsor students in high demand careers such as STEM, business or k-12 teaching where there is a shortage of math and science teachers. The federal government cannot do this alone teaming with corporate America.

-

Raising Ambitions: The Challenge in Teaching at Community Colleges – NYTimes.com

Overwhelmed and underpaid yet community colleges continue to offer the surest route to solid career for AA or for the driven students move on to pursue a BA/BS degree.

-

Only a quarter of LaGuardia students complete their associate degree in six years, a figure that is high for urban community colleges.

-

Five years ago, with Detroit’s deadened factories as a backdrop,

President Obama announced an initiative to mint five million more community college graduates by 2020. -

Two-year colleges enroll nearly half of all undergraduates in this country, the majority coming from the lower half of the income distribution

-

what would intuitively seem to be one of the most crucial elements of increasing success rates: improving the quality of teaching.

-

And teaching at community colleges bears little resemblance to teaching anywhere else

-

LaGuardia loses about one third of its students during their first year; without engagement, the prospect of their success seems all but impossible.

-

At LaGuardia, where some of the city’s least-prepared students land, and where he has taught for 10 years, he is, in some sense, involved in a near-constant project of professional development. His classroom is his laboratory.

-

To create a world of young people skilled at analysis you first need to create a world of young people receptive to complexity, and many of Dr. Vianna’s students, he said, “cringe at complexity.”

-

Dr. Vianna got an illuminating look into how deeply some students question the intrinsic value of learning

-

Often learning requires changing one’s position toward some issue and they resist this.”

-

Compensation is hardly robust; the average salary for a professor at a two-year college is $61,000 a year, 28 percent lower than the average at a private four-year institution.

-

During the past year, LaGuardia has hired 70 new full-time faculty members (for a total of 400), nearly two-thirds of whom have Ph.Ds. The other 800 instructors, however, are adjuncts.

-

Life for academics at community colleges scarcely resembles a David Lodge novel.

-

None of this can be assumed at a community college, where “the idea of academic discourse is completely foreign,” Melinda Karp, assistant director of the

Community College Research Center atColumbia University , said. -

Teaching is rarely mentioned in doctoral programs, and at elite colleges and universities it is not nearly as relevant to the outcome for students.

-

suggesting that by the time students enroll in an

Ivy League institution, college itself only negligibly affects their intellectual development. -

Data on what kind of teaching works most effectively at the community college level is scant.

-

“There’s a lot of talk about moving community colleges to more constructivist approaches,” Ms. Karp, of Columbia’s Center on

Community Colleges , said. “The challenge is how do you get there?”

-

-

Sizing Up the College Rating System – NYTimes.com

A first step in rating colleges that can later be improved to improve the graduation and employment rates for low income students. What is needed is full transparency by colleges and universities.

-

The department’s struggle to build a workable rating system shows the difficulty of representing the complexity of an individual college’s contribution to society in a single number.

-

The newly released rating framework identifies three main elements of institutional quality: affordability, access and outcomes.

-

President Obama has promoted the ratings as a tool for students choosing colleges. Does it make sense to steer them toward one that has significantly improved from awful to barely mediocre, or is good only compared with its very bad peers? -

If too much emphasis is given to the price colleges charge low-income students, colleges might be tempted to give generous aid packages to a handful of token poor students while admitting mostly rich kids. (This is essentially the current business model for many elite schools.)

-

If, on the other hand, too much weight is given to the number of low-income students enrolled, colleges might be inclined to enroll many such students, cash their federal grant and loan checks and then let them drop out.

-

Many public university leaders have supported the ratings plan

-

With the nearly 70 percent of undergraduates who borrow to pay tuition now graduating with an average of loan balance of almost $30,000, the government wants to hold colleges accountable for their success — or failure — in preparing students to manage their debt.

-

a deep unease in academia with the prospect of government officials making any kind of judgment about whether colleges are doing their jobs well.

-

-

E-Sports at College, With Stars and Scholarships – NYTimes.com

These guys and gals can earn big money and build up their e-gaming career. Why not skip a few years of college maybe after earning millions of dollars colleges will pay them to be part of the staff.

-

But Mr. Tran is not a star on the football team, or a leader in student government. He is a top player on the school’s competitive video game team, helping San Jose State claw its way to victory in June over

California State University, Fullerton , in a tournament watched online by nearly 90,000 people. -

Video game competitions, also known as e-sports, have taken off on campuses across the country, including Harvard and

Florida State University . -

Winning a big tournament can sometimes earn players several years’ worth of tuition money.

-

The companies now underwrite scholarship prizes, offer team banners and provide organizational support, sensing a possible breeding ground for a new generation of superfans — people who not only play games but also consider them a spectator sport.

-

While e-sports groups are often sanctioned clubs, receiving practice spaces from their schools, the leagues and competitions have few of the student regulations governing traditional college sports, like grade-point minimums or time limits on practicing.

-

The rise in e-sports has been so abrupt, many schools have not determined what to make of it

-

The time commitment required for serious competitive gaming could lead to concerns about whether e-sports leave enough time for academic study

-

In September, Blizzard flew eight finalists from the

College of Staten Island , University of Massachusetts-Amherst and other colleges to Seattle to compete for $5,000 in scholarship money in a tournament of Hearthstone, a virtual card game from the company. Last year, Azubu, a games media company, sponsored a competition that awarded $40,000 in prize money to six students on aStarCraft II team from theUniversity of California, Berkeley . -

A team of five students from the University of Washington won in front of a roaring audience at an e-sports studio that Riot operates in

Manhattan Beach, Calif. , with 169,000 more people watching online at the tournament’s peak. -

The growth of competitive gaming at colleges mirrors the broader rise of e-sports as entertainment.

-

. Twitch, a video streaming service that made its name broadcasting e-sport matches, was acquired this year for close to $1 billion by Amazon.

-

The college scene is largely organized around the Collegiate StarLeague, which started at Princeton in 2009 and is the biggest college league

-

The money that game companies are pouring into the college scene has persuaded many students to become much more serious about e-sports.

-

The money that game companies are giving to students, in contrast, is meant to deepen the companies’ relationship with a whole generation of players, one that is inseparable from their products.

-

Today, most professional players skip or delay college, because the college-age years are considered the prime period for players in the big leagues.

-

These guys and gals can earn big money and build up their e-gaming career. Why not skip a few years of college maybe after earning millions of dollars colleges will pay them to be part of the staff.

-

-

While even bench warmers in the

National Basketball Association make more than $500,000 a year, the same is not true of professional gamers. -

Game companies and collegiate league organizers predict that college e-sports could become a pipeline for the growing professional circuit.

-

Robert Morris University Illinois

-

-

E-Sports at College, With Stars and Scholarships – NYTimes.com

-

How Many People Don’t Pay Their Student Loans? – Total Return – WSJ

Is it high or low depends on the agency.

-

Amid concerns about rising levels of student debt and high default levels, the

Consumer Bankers Association , a trade group of lenders, has said that “only 3% of private student loans are seriously delinquent.” The association is citing data from MeasureOne, a San Francisco-based firm that tracks the student-loan market. -

-

-

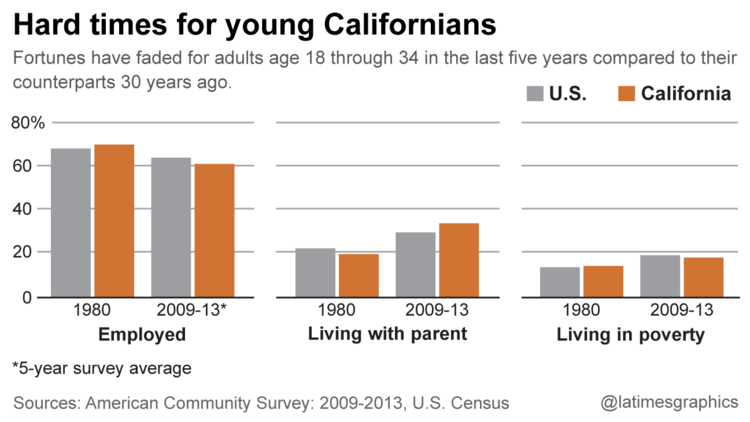

Millennials stand on shakier financial ground than older generations – LA Times

-

Why so many students are spending six years getting a college degree – The Washington Post

Let’s implement the one year AA degree and the three year BA degree with the last year as an internship then we will see an increase in overall college graduation.

-

But there’s increasingly a new norm for students: spending six years getting a degree.

-

Taking longer to graduate isn’t cheap. It costs $15,933 more in tuition, fees and room and board for every extra year at a public two-year college and $22,826 for every added year at a public four-year college, according to a new report by the nonprofit Complete College America.

-

Colleges have added too many unnecessary degree requirements and remedial courses that keep students in school for much longer than needed, according to the report.

-

"Most colleges and universities raise tuition and fees each year, while financial aid stays nearly constant,"

-

"As scholarships and savings run out, students and their families are left to borrow more of the costs of attending school."

-

At the

University of Arizona , only 34 percent of students graduate within six years, -

If schools want to rein in costs for students, Complete College America recommends they streamline curricula and cap the number of credit hours needed for bachelor’s degree at 120 hours and for an associate degree at 60 hours.

-

Capping credit hours, the report says, would make it easier for students to graduate on time as long as they take 15 credit hours a semester.

-

it’s hard to argue against more streamlined programs—and a return to four years as the norm again for college.

-

Complete College America wants schools to offer remediation alongside college-level courses,

-

About 20 percent of college students are enrolled in remedial classes,

-

Another part of the problem, according to Complete College America, is the "broken" system of remedial courses that students with weak academic records are required to take.

-

Nearly two thirds of students at community colleges, for instance, attend part-time because of those sorts of obligations,

-

Earning an associates in two years would certainly reduce costs for those students, but increasing their grant aid would arguably be more effective.

-

Still, schools could do a better job of creating a more direct route to graduation,

-

As it stands, only 50 out of the more than 580 public four-year institutions report on-time graduation rates at or above 50 percent for their first-time, full-time students,

-

-

Simpsons in the mobile connected classroom Fall 2014

Simpsons in the mobile connected classroom. Teacher has a blackboard and helpless. Integrate those smartphones, tablets other devices into the classroom.

-

Student Debt: A Calculator Focused on College Majors – NYTimes.com

Check out the student loan debt calculator by college degree. Instead of the 6 month student loan deferral the feds should raise the deferral or grace period to 1 year or more depending on the debt, provide time until the newly minted graduate has a decent gig to repay uncle sam.

-

How many Asians are in management or leaders of colleges or universities? Our woefully underfunded k-12 system yet what can other minority groups learn from the Asian community.

-

A group called Students for

Fair Admissions filed lawsuits Monday againstHarvard University and theUniversity of North Carolina in federal court. The suits argue that the schools use race preferences to reach a specific racial balance on campus and have failed to abide by the strict scrutiny of racial preferences required by the Supreme Court. -

lawsuit calls a de facto quota on the number of Asian students the school admits

-

Over the last eight years Asian students have comprised between 17.6% and 20.7% of students admitted to Harvard.

-

the admissions evidence suggests that the school is reserving pre-rationed pie slices for racial groups.

-

The university itself did a study showing that it could increase diversity on campus by admitting the top 10% of the state’s high school classes more than with racial preferences

-

Now we see that in pursuit of diversity, schools treat some minorities as less equal than others based solely on race. Nothing holistic—or constitutional—about that.

-

Comments

Trackbacks

-

[…] Here’s What Will Truly Change Higher Education: Online … […]

In my opinion, I feel that this would help many that couldn’t finish High School, or that didn’t get a degree. This would be a great idea and it could help many of us.

I liked the article very interesting and Emily thinks so too : )

This article was very interesting. It is an accurate article about loans and so much more. This may help many to get more educated in what they are getting into .

This article had many information for how we can change Education. These are really good ideas and can help many students.

Online classes are not as hard as you may think they are. You just need to make sure that you keep up with all of your classes and keep your grades up.

The article can help many people who don’t think college is for them. Online classes are a good way to get a college education without even leaving your house.

need college help is a great place to get information on all your college problems.

The article is very interesting and helpful in so many different ways. It gives a lot of details about college and is informative =)

This website gives out good advice for college. I hope to apply this stuff in the future.

I had owed a fine in the library for not going to pick up books I had put on hold on time. Because of this i couldn’t check out any books and had to read what i already had. I checked out books that help with different writing styles and authors.

Thanks so much payan. I am connected more with my friends as well as getting more comfortable with G-Metrix. Which helps with future jobs, Thanks so much for the help Payan and giving me the strength with working with the W-WORD slide!!!!! I would like to tell my friends about the fun times in this class.

This website is very informative. It gave me more information then i thought was on it. It was very helpful for certain things.

This article gave a lot of infomation about college. I found it very helpful because it made me get a better understanding on tuition.

This article gives hope to people who think that they can’t get an education. It is good for people who struggle with going to school because they do not have enough time on their hands, but with online courses they can finish on their own pace.

This article gave me a lot of useful information about college and my options.

this article is very interesting and has a lot of useful information about college that could help students

This article is very interesting and has a lot of information on college that could help many students. This article can help many students who are struggling in school that don’t have a lot of time but online course can help them and they can finish on there own pace.

I find this article intriguing and very informational in helping me think out my options. It gives me a second thought on my plans after leaving high school and moving onto college.

I find it always a good thing to explore my options when it comes to learning and college and this article I found was very informative.

Thank you so much for an amazing second semester, it’s been a blast being in your fourth period class. I got to play a lot of fun games on the computer and improve my knowledge of technology with my friends. I also really liked not having any homework in this class. -Brandon

I chose these schools because they are listed as having some of the best Creative Writing programs for aspiring writers, which is what i want to be. Three Majors I would choose are Creative Writing, Journalism, and Mass Communications. Creative Writing would help improve my writing skills, while Journalism and Mass Communications would help me become an experienced editor, so that I can not only edit my own work but so I can also edit others. Mass Communications will also help me to branch into other areas of editing involving audio and video.

NYU

https://www.nyu.edu/clubs/css/static/images/nyu-icon.jpeg

Meal Plan Options

Residential students will automatically be enrolled in the 10 meals per week meal plan; students may opt for a meal plan option with more meals. There is no meal plan requirement for non-residential students, although they are welcome to purchase a meal plan for meals on campus.

8 meals and $30 Dining Dollars per week: $130/week ($780 total for program)

10 meals and $30 Dining Dollars per week: $140/week ($840 total for program)

12 meals and $30 Dining Dollars per week: $160/week ($960 total for program)

21 meals and $30 Dining Dollars per week: $225/week ($1,350 total for program)

AnBryce Scholarships

Through the generosity of the AnBryce Foundation, this scholarship is awarded each year to a small number of academically-motivated students who demonstrate financial need and who are the first generation in their family to attend college. The award will cover up to the cost of tuition and is renewable over four years of undergraduate study at NYU. These Scholars will participate in a rich combination of orientation and mentoring programs, as well as educational and cultural activities. Students are expected to maintain a minimum GPA of 3.5 each year and to participate actively in program activities. There is no application to be considered for this scholarship. Applicants are automatically considered through their admission application materials.

Martin Luther King, Jr., Scholarships

Since its inception in 1987, the Martin Luther King, Jr., Scholars Program has awarded over 400 need-based and merit scholarships to incoming freshmen at NYU. These students present records of outstanding academic achievement, leadership, and commitment to the principles of community service, humanitarianism, and social progress.

MLK Scholars help to plan and participate in academic and cultural events that draw on the vast resources of New York University and New York City. They explore cultural diversity through domestic and international travel and take the lead in helping others through community service. There is no application to be considered for this scholarship. Applicants are automatically considered through their admission application materials.

2014-2015 Academic Year 4 Units 6–10 Units 12 Units

Tuition (per semester) $5,156 $10,302 $13,797

Registration Fee (per semester) $656 $787 $917

Room and Board $2,190–$16,782 $2,190–$16,782 $2,190–$16,782

Books and Supplies $1,070 $1,070 $1,070

Transportation Up to $1,008 Up to $1,008 Up to $1,008

Personal Expenses $2,000 $2,000 $2,000

UNIVERSITY OF IOWA

https://www.apexcareers.com/images/success_stories/hawkeyeslogo.png

Billed expenses

Nonresidents

Tuition & fees * $27,890

Housing & meals** 9,728

Subtotal $37,618

Other estimated expenses

Nonresidents

Books & supplies $1,240

Personal expenses*** 1,482

Transportation 456

Subtotal $3,178

Total estimated costs $40,796

Presidential Scholarship Program

For incoming first-year students

Value:

$40,000 ($10,000 a year for up to four years)

Minimum Requirements:

30 ACT (or a combined SAT critical reading and math score of 1330) AND a 3.80 grade-point average (GPA) on a 4.00 scale

Old Gold Scholarship

For incoming first-year students

Value:

$20,000 ($5,000 a year for up to four years)

Minimum Requirements:

30 ACT (or a combined SAT critical reading and math score of 1330) AND a 3.80 grade-point average (GPA) on a 4.00 scale

Advantage Iowa Award

For first-year students who are U.S. citizens or permanent residents whose enrollment will contribute to a diverse learning environment

Value:

Iowa residents—$2,000 to full undergraduate tuition (amount may increase based on demonstrated financial need)

Nonresidents—$2,000 to $8,000 (amount may increase based on demonstrated financial need)

Minimum Requirements:

The award is based on merit (test scores, GPA, class rank). Criteria may include one or more of these: student’s race/ethnic background; socioeconomic factors; whether the student is a first-generation college student (parents have not graduated from college); participation in a federally funded Upward Bound program.

UNIVERSITY OF TEXAS

http://upload.wikimedia.org/wikipedia/commons/2/2f/Large_university-of-texas_seal_rgb(199-91-18).png

“Design-A-Sign” Scholarship Contest

Deadline: 5/29/15

Available to: High School Freshman through College Seniors

Award Amount: $1,000

Niche $2,000 No Essay Scholarship

Deadline: 5/31/15

Available to: High School Freshman through Graduate Students, Year 5

Award Amount: $2,000

Duck Tape “Stuck at Prom” Contest

Deadline: 6/01/15

Available to: Ages 14-18

Award Amount: $10,000

On-campus Housing Costs

Shared space begins at $9,272 and goes up to $11,672

Single space begins at $11,156 and goes up to $15,441

I want to go to

– university of Michigan

-university of Washington

-university of California Los Angeles

I want to attend these colleges because they would best suit my majors, which are: sports physician, literature professor, and photographer

The salaries of these careers are highly paid careers. By getting accepted to any of these colleges I would have accomplished a mile stone in my life.